What First-Time Homebuyers Need To Know, Say HGTV Stars Sarah And Bryan Baeumler

Buying your first home can be equally exciting and anxiety-inducing. Navigating this time can be quite difficult, even if you go into the process as prepared as possible. Many people think first about the overall costs and Nerdwallet concurs that starting to save money early can be a major benefit. Your savings can help you cover the down payment, closing costs, and move-in expenses, which will run up into the thousands even with great credit. There are plenty of other factors, such as the home itself and current interest rates on mortgages, that can increase this initial price.

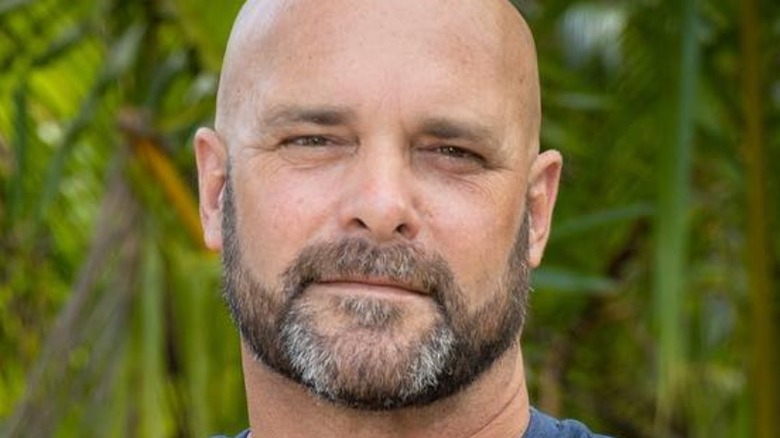

But the budget isn't the only consideration first-time homebuyers should keep in mind. Through years of experience in purchasing new homes to renovate, HGTV Canada stars Sarah and Bryan Baeumler have learned the keys to successfully making it through the buying process. Royal Bank of Canada reports some of the top tips this knowledgable couple believes anyone in the market for their first home should know.

Location is a top priority

Cosmetic upgrades are easy, and even a major renovation can be done, but the location of your home is one element you cannot change. Therefore, choosing the right location should be a top priority when you're first looking to invest in a home. "When it comes to our first home, we made a very smart decision," Sarah Baeumler told Royal Bank of Canada. "We bought for the location, we bought for the land. We saw all the potential it had, which made it a smart investment at the time."

What makes a good location for one potential homeowner may not make it onto the priority list for another. Think about what you want and create a checklist to help you choose the best option. Consider how close a neighborhood is to amenities like grocery stores, restaurants, and shops, suggests Investopedia. Are you able to walk to them, or will you need to take public transportation or drive?

For parents, location often affects where their kids will go to school. It might also be important to live near other families or parks where children can play. Lot location can be a factor, as many wouldn't want to live near a highway or on a busy road. Crime and safety may also be top priorities when it comes to location. These are things you can't change once you're there, but you can control before you buy.

A solid foundation

Unaddressed issues with the foundation of a house can create major problems that cost lots of money to fix, and no new homeowner wants to invest in their dream home only to sink more cash into it because of a bad foundation. "[A foundation] is the keystone that you build everything else off of," Bryan Baeumler told to Royal Bank of Canada. "A sound, stable foundation will increase the longevity of the property and allow you to build and renovate with confidence if you want to make changes down the road."

Luckily, there are some signs that can tip you off to a home with foundation issues. One of the biggest indications is cracks, especially on the exterior facade and interior sheetrock, explains Structured Foundation Repairs. Tiny cracks in steps or on the exterior and interior walls aren't typically a cause for concern, but large cracks that zig-zag are a sign of serious problems. Cracked or protruding exterior bricks can also be a sign. The same goes for cracks at the point where the walls and ceiling meet.

Consider size and layout

Size and layout come into question in regard to your lifestyle more than anything. The Baeumlers suggest asking yourself if the home in its current state fits your lifestyle (via Royal Bank of Canada). What about your future lifestyle? This doesn't mean that the home you buy has to fit perfectly into all of your wants and needs, although that would be a major benefit. Homes with potential can be just as good of a choice when buying for the first time.

What you want to consider is if the size of the home will work with your basic needs. Is it enough space for everyone who will live there to be comfortable? Does the home have enough space for hobbies, activities, or work you want to do? Answers to these questions can also affect how you feel about the layout of the home.

For families, extra bedrooms are always a good idea, as are mudrooms to hold backpacks and sports equipment, says Toll Brothers. Maybe you need a kitchen island that can pull double duty as a homework space or multiple en-suite bedrooms to accommodate privacy needs. If you love to cook, a large kitchen might be a top priority, along with an open layout if you like to entertain friends and family. Of course, you might have a combination of these needs and others, so the perfect layout and size might look different from your neighbors.

Set a buying budget

Homebuyers know that getting their finances in order is essential, and you should set your buying budget before you begin looking. The worst thing would be falling in love with a home that you later find out you can't afford. "It's important to buy below your budget so you can make improvements if you need to," Bryan Baeumler suggested to Royal Bank of Canada. Whether you're planning a cosmetic makeover or a total renovation, having the cushion worked into the purchasing budget will be useful in the long term.

When it comes to estimating a price range, a good place to start is by multiplying your gross annual income by 2.5, says My Home by Freddie Mac. This is only a starting point; your credit score and the scores of anyone else you're buying with will determine your mortgage options. Mortgage rates can also impact your buying power; specifically, lower rates can make a new home more affordable. A down payment and closing costs will also affect your buying budget.

Consider carrying costs

The amount you can spend on purchasing a home isn't the only number to factor into your budget. You should also consider how much it will take to operate and maintain your home, also known as carrying costs. These costs include heating and cooling the home, property taxes, and any other ongoing maintenance needed. You don't want to settle on a home that you can afford to buy yet can't afford to maintain. Before making a purchase, look at the estimated carrying costs of the home by seeing the property taxes and bills paid by previous homeowners.

Add in regular bills that you'll have to pay monthly. According to American Family Insurance, the average monthly utility bill can fall around $200. You might also have an HOA that can cost $250. Furthermore, monthly property taxes average $220 and lawn care can be close to $130 a month. Consider if you're able to front these costs every month on your new home before purchasing.