The 15-Year Mortgage Rate Is Rising At An Alarming Pace

Anyone who has ever gone through the process of buying a home knows that there are plenty of steps to follow before you are handed the keys. In fact, prior to looking up what properties are available in your desired neighborhood, it would help to know what you can afford to buy in the first place. There's no point ogling million-dollar homes in Hawaii, or drooling over expensive Los Angeles estates when you should be checking out places that are more realistically in your price range.

Also — unless you have more money than you can count waiting at your disposal — chances are that you'll look into some type of lending so that you can afford to purchase the residence you want; that could mean borrowing the funds to buy your home from a bank or other type of financial lender. Before you visit these institutions looking for a mortgage, however, there are many things you can prepare in order to get the best interest rate and loan you can. According to Forbes, having a good credit score, a positive debt-to-income ratio, and all of your paperwork in order can help you to get the best option possible. However, there's one factor that remains out of your control when it comes to homebuying expenses, and that is the overall loan rate. Unfortunately, as it stands, it looks like the cost of getting a mortgage is rising rapidly. Let's take a look at how much and why this is happening.

Mortgage rates are on the rise and here's why

It helps to know what's involved that can affect the change in mortgage rates. Along with your own personal factors such as credit score, personal income, and the down payment amount you are able to afford, outside situations also impact the rate of your loan. Factors like the state of the economy and the Federal Reserve's influence can contribute to lower or higher rates, according to Time.

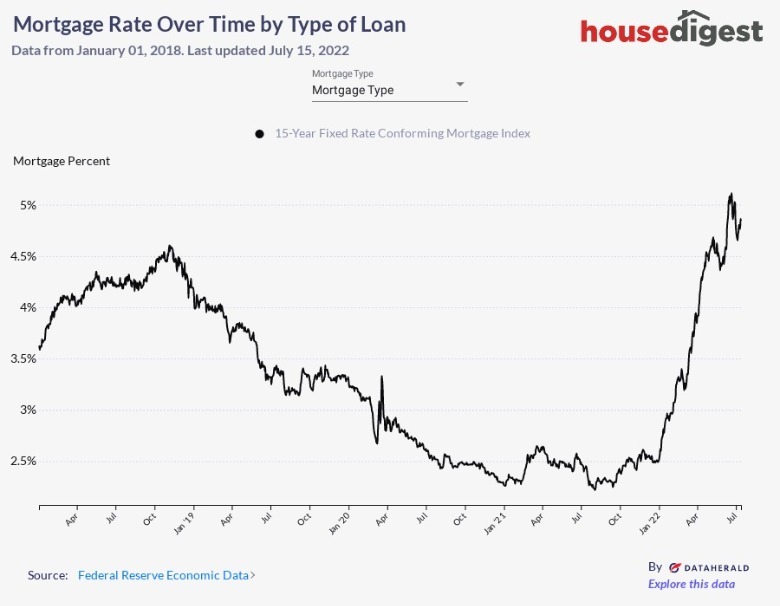

Information provided by Federal Reserve Economic Data shows a decline and then a rapid increase in 15-year mortgage rates over the course of just a few years. The lower 2% to 3% mortgage rates in 2020 and 2021 were largely due to the hit the economy took when dealing with the COVID-19 pandemic. With an increase in unemployment in 2020 — according to numbers collected by the U.S Bureau of Labor Statistics — mortgage rates took a dip to help homeowners at risk of not being able to afford monthly mortgage payments, as per Forbes; this could also encourage refinancing to ease the financial burden of higher monthly payments.

With inflation on the rise, people can expect higher costs in such products as food, gas, and housing, according to The New York Times. With regards to the latter, this means rising mortgage rates. For 15-year mortgage rates, it seems they're hovering around 5%, which is a far cry from the lower rates of just a few years ago.