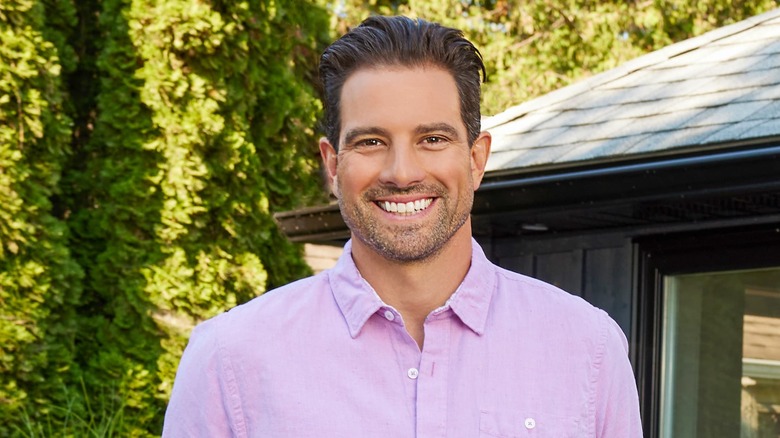

HGTV Star Scott McGillivray On His Best Tips For Vacation Rental Investors - Exclusive Interview

As a skilled contractor who has done hundreds of vacation home renovations, Scott McGillivray knows how to transform even the most unassuming properties into dream destinations — and as a real estate expert, he also knows exactly what it is that makes a vacation property a great investment. As the star of HGTV's hit series "Vacation House Rules," McGillivray helps homeowners unlock the full potential of their spaces not only for themselves to enjoy, but for future renters as well. By investing in the right property, making the necessary upgrades, and understanding how to create the best possible experience for your guests, it's possible to make passive income on your vacation home while you aren't using it.

In an exclusive interview with House Digest, Scott McGillivray discussed the upcoming season of "Vacation House Rules" and shared some tips for other vacation homeowners looking to profit from their property in a way that will create a return on investment — in addition to what he calls a "return on lifestyle."

Why Scott McGillivray is looking forward to Season 4

Congratulations on Season 4 of "Vacation House Rules." How does this season differ from past seasons, and what can fans expect to see this time around? Do you have any favorite or notable moments from filming that you're especially excited to see air or to have viewers see?

I'm excited because this is the biggest season we've ever done — it's the most episodes. We've got the biggest properties we've ever tackled. We got really ambitious for this season of "Vacation House Rules" to make sure that we've leveled up on our reveals, we've leveled up on our renovations and our locations, and I think people are going to be shocked and surprised when they see the new version of the show.

Obviously, I love what I'm doing, or I wouldn't be doing it. Being able to renovate these homes — which are also vacation properties — is special. We've been doing a lot of waterfront properties, which are still my favorite. I love being on the water. We did some pretty big properties this year; that was the big challenge more than anything. I am excited for people to see 4,000-square-foot properties with pools and lakefronts all together. It's a level up and even more aspirational than before, which is great, but for me, it's the variety.

I like to switch it up. I can be on a ski hill one day doing an episode, a week later we're in the woods in a luxe lodge, and then the next thing you know, we're doing a farm. We've got properties that are within vineyards ... It's been a year of variety, a little bit of everything. I don't know if I can say one particular property is my favorite. I definitely have some favorite homeowners.

What to consider before investing in the vacation house market

What kinds of things should potential buyers consider when looking to invest in a rental property that they may not have to consider or think about when buying a property solely to live in?

You want to make sure that it's something that you're going to get use out of [and] that you're going to love. A lot of people try to think about retirement and all that when they're buying a vacation property, and I call that a return on lifestyle. Return on lifestyle is critical, but you also need to consider return on investment. Is this going to help or hinder you financially?

For a lot of people, they don't realize there's expenses that come with these properties that can be pretty hefty, so the opportunity — or even just having the savvy know-how on being able to rent it as a financial solution — is critical. That's what I get most excited about for this show. We're giving people ideas on how they can have that dream home realistically. Realistically, you may have to rent it out from time to time, and here's the best way to do it so that you and your guests both have a tremendous experience.

What do you recommend potential investors, especially beginner ones, do in terms of prep and planning prior to diving into the rental market?

You need to understand your own finances first. You don't want to put yourself in a precarious position in order to purchase one of these properties, but if you do your research on the markets, the rentability, you look at the season — some areas have a short rental season, some areas have a long rental season, some areas have dual rental seasons. If you do your math and do your research, you should be able to make a qualified decision as to whether or not the property will work financially, and that's the critical first step. Am I going to be able to generate enough money to cover the cost of purchasing this property?

Are there any home features that you always recommend buyers be on the lookout for that inherently make a property a good rental investment?

The first and possibly the most important is the location. Waterfront properties are the number one category, and within that, it's beachfront properties. If you've got beach access — phenomenal. I have my own portfolio of vacation rentals, and when we list them on Airbnb and on the Stay app, we get a lot of metrics, so we see who's looking them up. What are people searching? People are searching beachfront properties, then they look for things like shallow entry or docks or western exposure, and they look for amenities like hot tubs and saunas. The first filter that they use is capacity, so you want to make sure that you're reaching the best potential capacity. How many bedrooms do you have? How many people can sleep in each bed, in each bedroom?

This isn't a guess-and-check business. On the show, we don't get into the minutiae, but behind the scenes, we're doing a tremendous amount of research in helping our homeowners to be set up for success so that they are monetizing these properties properly, they are marketing them properly, they're branding them, that we're naming each property, we're putting up 20 plus pictures on each property ... We're doing all the things that we know drive traffic and increase bookings.

Avoiding pitfalls of the vacation rental market and maximizing profitability

What are some easy improvements or upgrades homeowners can do to make their rental property more profitable?

[To] have a bit of a theme to your design is critical. It doesn't feel good to be in an inconsistent atmosphere. If it's disjointed and there's no consistency throughout, that's a challenge. We have learned over the years of doing this — I've done hundreds and hundreds of these vacation rental properties — that if you can get a strong design theme to a property ... If it's going to be a farmhouse, for instance, it's a property that's got a little bit of acreage [and] there's nothing in the surrounding area that attracts people, you need to generate the content within the property itself. It's about the design; it's about maybe having a nostalgic Western vibe.

We just did a property [that] is basically like "Yellowstone," which is cool because there's horses and there's bison on this farm. You don't have to maintain them, but they're right there in your backyard, which is cool. There's paths and ATVing that you can go out and do. The cabin is log, and we fixed it up and augmented it and even did some faux log so that the whole experience feels authentic. We brought in nostalgic cowboy pieces; we did a lasso course outside. These are simple things, so you come, you're busy when you're there, and there's lots to do, but we made it all — none of it was there. We created it all.

It wasn't expensive. These things cost a few thousand bucks to put some hay bales together, buy a few lassos, put some lines on the ground, and some fake horns on a bale of hay to go ahead and see if you can lasso. That's something that people might play with for hours, but it only costs a few hundred dollars, so it's a huge draw for the property. If you're clever, you can create an experience for people with these properties. And because they're not people's primary residences and everybody's just there for a short period of time, you never get bored of the theme.

Do you have any renovation or real estate mistakes that you made in the early years that you want to warn other beginner investors about, or have advice for them so they can avoid making the same ones?

I've made all the mistakes. I've tried different strategies in real estate, wholesaling, tax liens, tax deeds, flipping. Buy and hold is by far the most profitable strategy in real estate; that's why I gravitate back to it, whether it's short-term or long-term rentals. I always end up aiming all of our programming toward the most successful strategies for real estate investors. The short-term rental market is fun because it's high profits [and] high turnover, which is what you want, but it's also aspirational for people. They like to use their own properties; everyone can use their own vacation rentals.

You have to love what you're doing, you have to believe in the properties that you are investing in, and don't be scared. Fear is the number one thing that stops people, but fear can be solved through education. Educate yourself on what the strategies are and do it.

Watch the Season 4 premiere of "Vacation House Rules" Saturday, June 3 at 9:00 p.m. ET/PT on HGTV.

This interview has been edited for clarity.