10 Important Things You Should Be Keeping In Your Fire-Proof Safety Box

We may receive a commission on purchases made from links.

Your home should be a sanctuary from the rest of the world. It's the one place where your important and sentimental items are unlikely to be lost, stolen, or damaged. However, this is only the case if you store items the right way.

No matter how safe your neighborhood or city seems, there's always the risk of an unexpected disaster or burglary in your home. You also never know when a disaster may hit, like a fire in your home. These events are often outside of your control, making it important that every homeowner owns a fire-proof safety box. These fire-resistant safes withstand heat over a thousand degrees Fahrenheit, repel water, and are locked behind a keypad, fingerprint reader, or traditional lock and key.

Higher-quality safes are more expensive but promise more heat resistance and a better locking mechanism. No safe is 100% impenetrable, but they still provide an extra barrier between your most important belongings and the outside world. They also serve as an organized hideaway for keeping crucial everyday documents in order and readily available. Below are some highly valued household commodities you should consider storing in one of these safes to protect yourself and your assets.

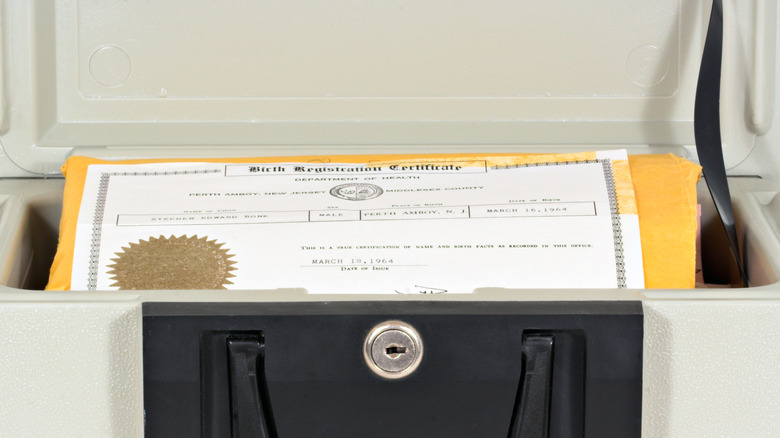

Hold onto the original versions of birth certificates

In 2005, all but four countries in the entire world agreed to officially register children at birth. Not all countries have kept their word, but everyone legally born in the United States is issued a birth certificate. You need this document as proof of your age, citizenship, and identity, and it's a necessary form of identification (ID) for when you apply to schools and jobs, and for official licenses, government benefits, and travel passports.

Due to the importance of this document, you must do your best not to misplace or lose it. Keeping the certificate in a fire-proof safety box protects it from damage and thieves during unfortunate times. It is possible to replace a lost or damaged certificate, but the process may be tricky depending on your state and what ID forms you have. Birth certificates younger than 125 years old are confidential, meaning only specific individuals can request them. The registrant (if they're over 18), the listed birth parents, and a legal guardian are the only ones with access to it. Others can make the request, but only after obtaining a court order.

Oftentimes, you need a photo ID, a notarized application, and other supporting documentation to request a new certificate. The process is complicated if you are missing any important pieces. Depending on your state, you'll also be charged between $9 to $34 for your request, plus an additional fee for rush shipping. It's far easier to keep your birth certificate locked up safe and secure than to deal with this strict legal process to replace it.

Keep an envelope with social security cards

Securing forms of ID in your fire safe box should be a running theme — you should also keep your very personal social security card safely nestled inside. These small rectangular cards have a nine-digit number that identifies each United States citizen as a taxpayer. You need your social security number, and often the actual card itself, to file taxes, apply for and claim benefits, apply to jobs and schools, open bank accounts and credit cards, and make large purchases throughout your life.

This number is highly sought after by thieves because they can use it to steal your money and identity, making your life incredibly difficult moving forward. Requesting a new number is no small task. You'll need to show proof of identity theft, harassment regarding your number, and your attempts to fix it before the government will relent and allow you a new number.

Luckily, obtaining a replacement card because your previous one was destroyed by fire, water, or another method is not so dramatic. You will need to fill out an application and bring original forms of IDs to local government offices. However, this time-consuming errand is entirely avoidable by simply keeping the original card in a safe, well-protected location like a fire-proof safety box.

Store passport cards and books alongside other travel documents

Add your passport and similar travel documents to the growing stack of important documents in your fire-proof safety box. After all, passports are necessary booklets among avid travelers and serve as an international ID for people traveling between countries. They include basic information like your name, birth date, and birth location. They also have information on the passport issue date, expiration, and number, alongside your photo and signature. There are different kinds of passports, including diplomatic types used by country representatives, collective ones for schoolchildren, and official booklets for government workers. You only need a passport on hand when traveling abroad, and it's smart to keep it somewhere safe and secure when you aren't hopping between countries and continents.

If it is lost or stolen, apply for a new one online, via mail, or in person. This process isn't difficult, but it is more costly than simply renewing a passport already in your possession. When you renew a passport book that's been cautiously guarded in a fire safe box for years, when you turn it in, you'll owe a flat $130 fee. On the other hand, if you fail to keep your booklet safe, buying a new one from scratch costs the same $130 plus additional acceptance, ID copy, and photo fees.

Collect spare keys to cars, houses, mailboxes, and storage units

Spare keys are a staple for adulthood. You can't go wrong with copies of keys to your car, house, workplace, storage unit, mailboxes, and other cherished commodities kept behind a lock. Most people keep their copies in a random drawer or cabinet, mixed up among other junk where it's easily lost and forgotten.

To avoid the anxiety of trying to find one of these keys when you need them most, try collecting them in a bag, labeling them, and storing them away in a fire-proof safety box. Keeping them with other essential items, such as the important documents listed previously, ensures you'll always know where to find them. You can rest easy knowing they're safe during disasters and break-ins, and you won't have to pay unnecessary replacement fees because you managed to lose them within your own home.

If you don't already have copies of these items, you may want to invest in them so you can store the duplicates in a fire-safe box. Standard keys, like ones for your house and mailbox, can cost only a dollar to copy. This is far cheaper than if you lose your keys completely and have to rekey all of your locks, which can cost between $75 to $220 per lock, depending on your location and personalized quote.

Protect expensive and sentimental jewelry pieces in a box

There are two types of belongings that people rush to save during emergencies: their most expensive and their most sentimental items. Sometimes, an item fits both of these categories, and this is often the case for fine jewelry. Many families pass down family heirlooms like necklaces, rings, and other priceless accessories. If you own such belongings and value them highly, you shouldn't leave them lying around in an unprotected box or cabinet.

When you aren't wearing it, store your most prized jewelry in a fire-proof safety box. This protects them during fires and other home disasters, and it complicates thievery for burglars during home break-ins. Depending on the type of emergency, insurance may cover the monetary value of these pieces if you pay to add a rider to your plan. This is better than nothing, but money doesn't physically replace your great-grandmother's engagement ring that's been passed down for generations.

On the other hand, jewelry lost to a home break-in isn't always recoverable either. A police report can only do so much. Even when thieves are caught, law enforcement cannot guarantee they'll find pawned off, hidden, or lost items. You can improve your chances of recovery by having jewelry appraised, documented, and photographed to show the police, which should also be kept in a fire-proof safe. You can also check local pawn shops and online listing sites yourself. Keep in mind that this entire process may be avoided by safeguarding your treasured collection in the aforementioned lockbox ahead of time.

Compile a list of insurance policies and account details

The older people get, the more insurance policies they open to cover various aspects of life. Many people keep physical and electronic copies of these policies, and it's smart to keep the papers organized somewhere easily accessed but secure. Take inventory of your various policies, including home, renter's, vehicles, life, and other miscellaneous types, and stack the documents together. Use a folder, envelope, or binder clip to fasten and tuck them away in a fire-proof safe.

In the case of an emergency, you may have access to many of these documents online, but it never hurts to have physical copies too. If you forget your online usernames, emails, or passwords associated with the accounts, the physical paperwork will have the information you need to regain access. It'll make it easier for an insurance agent to look up your pre-existing account and verify it's you.

Having physical copies also prevents uncertainty around claims, especially ones that occur around the same time as policy changes. The IRS also recommends keeping documents between three to seven years for tax purposes, especially if you're a business owner. In short, save yourself the hassle of tearing apart closets, bookshelves, and desk drawers trying to find these papers by locking them up with your other important documents and belongings.

Tuck away a checkbook and backup cash

Technology is so prevalent in modern day life that many people have forgotten the importance of keeping backup cash and checkbooks on hand. If you misplace your cards or phone, it's always a good idea to have cash to fall back on. Also, consider that while our cards and online bank accounts seem reliable, there is always that chance that a situation will require cash.

Tucking a small envelope with a few hundred dollars in a fire-safe box will cover you for a few days. Consider what you would do if your wallet and cards were lost or stolen. What if your credit card company freezes your account, there's a local power outage, ATMs are unavailable, or your bank undergoes a transition or has technical difficulties?

Cash and checkbooks may be your only method for making punctual payments in the interim. Remember that checkbooks are still usable when technology is offline. Therefore, they are an essential commodity for recording transactions on paper when they can't be electronically documented.

Compose power of attorney documents in case something happens to you

Only some people need to designate a power of attorney (POA), which is a person legally permitted to act on their behalf. People who are getting older, have debilitating medical conditions, or need someone to help them handle their finances, children, or healthcare, may decide to instate someone as their POA. If you are one of those people, you have more papers to add to the ever-growing pile in your fire-proof safety box.

POA documents outline what a person is entitled to do on your behalf, including applying for benefits, managing your money or business, making childcare decisions, and determining healthcare needs. All of these powers are established in an official document, which you should keep nestled where it can't be damaged or lost. In the case of an emergency, you need your POA to have access to this document so they can show proof of their legal rights.

They should have copies of this paper, too, but it's always smart to have a backup version in your own safe. This eliminates complications if you are incapacitated and unable to help them prove that they can make decisions for you. Just make sure they are aware of where these papers are and that they have the key or code to access your safe.

Gather sentimental photo albums and pictures

While most official documents are tricky to replace or duplicate, some belongings are simply irreplaceable. Unless you were born in the late 2000s, you likely have many Polaroids or one-copy photos taken before cellphones and electronic photo backups became the norm. Unless you've taken the time to individually scan and upload each of these memories into the cloud, losing the physical photo means it's gone forever.

You should take your loose photographs, scrapbooks, and any other irreplaceable memorabilia and collect them in a receptacle that is stored directly in your fire-safe box. Thieves will have little interest in your memories, but fires and water damage don't discriminate. If a natural disaster compromises your home, you don't want to risk losing decades of moments throughout your life.

In addition to your physical photos, also consider the photos you do have backed up on your computer and online accounts. No matter how secure online sites claim to be, there's always a tiny possibility that something could go wrong with your accounts. Whether your computer crashes, a family member inadvertently deletes everything, a hacker takes over, or you lose access to a platform, it doesn't hurt to copy your photos onto portable hard drives, CDs, or jump drives. Take these copies and place them with the rest of your photographs, ensuring you have the ultimate backup plan.

Retain receipts for tax deductions in the coming year

While a fire-proof safety box is an excellent place to store longterm paperwork, photos, and keepsakes, it also makes great short-term storage. Anyone who brings in income for themselves or their family must file an annual tax return. After evaluating your expenses and income, the government determines what you owe or what they owe you. Reduce how many taxes you must pay by diligently collecting receipts that can be deducted from that amount.

If you have health insurance, collect receipts for medical expenses, including premiums, co-pays, and other costs for medical, dental, and vision care. This includes prescriptions and medical tools, therapy sessions, appointments, surgeries, programs, and even transportation and parking costs associated with medical treatment. You should also hold onto receipts for childcare expenses, your training and education costs, and job-related purchases. Gas for transportation, plane tickets, office tools, marketing expenses, and work-related insurance can all be deducted if you hold onto these receipts.

Keeping a large pile of these receipts on hand and organized in a fire-proof safe saves you hours of tracking down expenditures when tax season rolls around. You won't have to search past emails and financial statements when determining the deductions yourself or handing the information to a professional. This keeps all receipts safe for as long as necessary and keeps you organized for your own benefit.