Home Sale Prices In Chicago Are Finally Trending Down

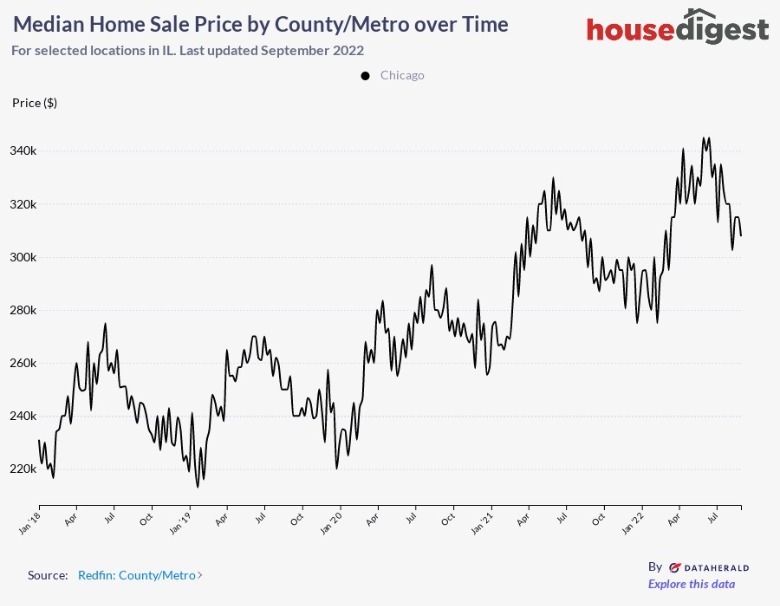

Good news is on its way for Chicago residents in the upcoming year, as home sale prices are finally trending down. House Data shows the median sale price of a Chicago home peaked at around $345,000 between May and June of this year, but by July, it started to decline. According to Norada Real Estate Investments, Chicago saw a 7.4% increase in prices in the last year, while the entire Cook County faced a whopping 10% increase, so it's about time the Windy City saw some relief.

As of July 2021, a total of 3,350 homes (both single-family and condos) were sold, but that number dropped by 27% in just one year. This is what's called a "housing bubble," which is a short period of time where housing prices inflate in response to other factors, like supply and demand, Investopedia explains. When the demand for houses is high but the supply is low, that's when buyers start to see a rise in home sale prices. Fortunately, the housing demand in Chicago is on a decline, and sale prices are following close behind.

Don't buy just yet

Norada Real Estate Investments says the Chicago housing market should expect a 0.9% decrease in house prices by next August. Because sales went down drastically this year, the demand for housing is becoming increasingly low; and as we just discussed, low demand means low asking prices. According to 23ABC, prices are expected to drop all over the country in the coming year due to high mortgage rates. However, that doesn't necessarily mean you should make any plans to buy. In fact, purchasing a home in 2023 may be more expensive than you think.

Mortgage rates are at an all-time high. As of right now, a 30-year-fixed-mortgage rate is around 5.4%, so even if you were to purchase a home at a low for-sale price, you're going to be making up for it in interest. For example, say you purchase a $200,000 home in Chicago, you'll end up paying another $23,000 by the end of those 30 years. With that said, as 2023 rolls in and Chicago housing prices go down, be sure to keep your eye on the mortgage rates before you buy.