Bad Home Advice Dished Out On House Hunters

"House Hunters" has been a staple of home-themed television for decades, providing fans with over 200 entertaining seasons (via Imdb). For years, viewers have followed prospective homebuyers in their search for a new place. Episodes have highlighted everything from minor conflicts to home-buying disasters along the way. The unique behind-the-scenes concept proves that every buyer is unique and no homebuying process is exactly alike.

During most of the episodes, professional realtors are enlisted to assist the buyers in their hunt. Many times, these real estate pros get a little too eager to offer advice. Over the years, there has been some terrible guidance provided to buyers — often multiple times in one episode. There are also habits that could lead to an expensive and regrettable home purchase. Some realtors even offer advice that could compromise their client's long-term financial health. So, when you're ready for your own home search, avoid these terrible pieces of advice from "House Hunters."

Considering houses outside your budgetary comfort zone

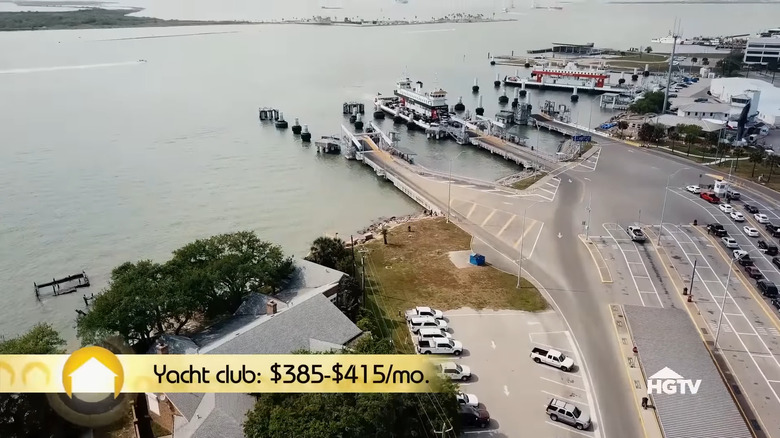

One of the most alarming trends that occurs on "House Hunters" is reckless budgeting. Most episodes begin with clients discussing their budgetary restrictions with their realtor. One glaring thing that is often missing from these talks is the inclusion of necessary HOA payments, community fees, or other additional costs. These can add significantly to a home's monthly costs and shouldn't just be ignored as a factor. Often when these come up during a showing, the agent glosses over them as an afterthought.

Some realtors also show their clients homes that veer wildly from their price range. At best, this leaves buyers disappointed when they aren't able to afford a home they've fallen in love with. They'll also be so impressed that the ones in their realistic price range will seem lackluster. At worst, buyers stretch themselves too thin and leave themselves financially insecure. If they eventually can't make the payments and lose the home, they could regret the irresponsible purchase for years to come. A foreclosure says on your credit report for seven years, making it tough to rebound (via Experian).

When the situation arises that a couple on the show doesn't see eye-to-eye on the budget, their realtor is in a tough spot. They need to either accommodate the lower end of the budget or veer the more frugal buyer to a higher price point. Sometimes, this leads to awkward interactions as realtors show the buyers houses that fit the higher budget. Couples are pitted against each other and it's implied that the realtor agrees that spending more is the best course. However, the best guidance, in this case, would be that the buyers seek financial advice from a pro. That way, they can get on the same wavelength and are armed with trusted knowledge to guide their search.

In fact, overbudgeting is a running joke for House Hunters

Even though viewing homes that run far over budget happens often on "House Hunters," it doesn't occur in every single episode. Still, viewers can often rely on this early segment for a few laughs. This has happened so frequently over the years that it's become a trending joke among internet users. As Buzzfeed points out, some guests on the show have some pretty obscure occupations. Viewers joke that contestants have careers in everything from Dorito art to porcupine quill gathering. While these are exaggerations, the punchlines are all the same. After describing their random professions, the couple reveals an obscenely high budget that leaves viewers perplexed.

In all seriousness, "House Hunters" seems to have a real problem with setting unrealistic expectations. Homebuyers are making a long-term financial decision that they'll be responsible for funding for decades. When you get a loan like a 30- or 40-year mortgage, the best plan is to have adequate financial security for decades to come. Whether this comes in the form of a stable career or a solid savings strategy, planning ahead is a must. It's ill-advised to suggest that those with random job positions and unpredictable careers should buy expensive homes. Instead, it should be recommended that these buyers get established in solid careers before buying. As Shane Lee, corporate communications analyst for RealtyHop, tells Investopedia, "Owning a home requires a huge financial commitment, and if your income is going to fluctuate in the next three to five years, it might not be ideal for you to buy."

Selecting from just three properties

Another idea that "House Hunters" perpetuates is that a home buyer should look at three properties before making a selection. After the couple has viewed the final home, they make an offer on one of the properties. While some mention that the buyers have been browsing the market for some time, the only consideration shown is between just three properties. This only gives viewers a snapshot of the home-buying process that's limiting and skewed. The show has time constraints and likely couldn't follow buyers throughout the whole journey. However, there are times when more can be done to prepare buyers for just how long and arduous the house-hunting process can be.

As buying a home is a huge decision, finding the best one for your budget shouldn't be rushed. Money Tip recommends first-time home buyers view 6 to 12 houses before pulling the offer trigger. They should get to know potential neighborhoods and get a feel for what they would love in a home long-term. This takes experience and exposure to various homes, styles, and features. So, often, the more homes you get to see in your process the better. Pop into lots of open houses, visit area model homes, and take virtual property tours online. You'll want to come away with a better instinct for what works for you and what doesn't. So avoid the urgency portrayed on "House Hunters" and take the time to find one that you'll be happy with for years to come.

Overlooking good bones for simple swaps

When it comes to home shopping, one of the most important, and unchangeable features is location. Another is the bones, or layout, of the house. This includes the set up of the living spaces, number of bedrooms, and desirable features like garages and finished basements. Many buyers have a must-have list that includes many of these specific needs. However, some homebuyers are quick to dismiss seemingly ideal properties for some pretty petty reasons. It's a familiar "House Hunters" scenario that a guest walks into a home that checks all of their boxes to the glee of the realtor. Then, they are shockingly upset about easy fixes like the color of the paint or outdated light fixtures.

Many realtors on the show miss a prime advice-giving opportunity in this situation. They fail to point out that painting a property or swapping out light fixtures can be simple DIY fixes. Even, if you opt to pay a pro, having an interior painted averages less than $2,000 (via Forbes). And, having new lighting installed typically costs under $200 (via The Home Depot). This is a small price to pay for a home that's otherwise ideal. So, would-be home buyers should keep in mind — stay focused on the bones of the home instead of getting distracted by easy changes.

Not discussing inspections and final walkthroughs

"House Hunters" episodes tend to leave out a very important part of the home-buying process. Viewers see the buyers weigh three options before telling their realtor to make an offer. Then, after a commercial break, suddenly the couple is moving their belongings into a home. What is nearly never mentioned is the due diligence that needs to occur in between.

Conducting a final home inspection is high on the list of suggestions that any real estate should give you. In fact, many home buyers won't put in an offer without the caveat of the property passing a third-party inspection. This is called a contingency, one of the most important real estate terms that buyers should understand. When shopping for a home, it's important to keep in mind that an offer isn't a done deal. Buyers have the right to have the property inspected to fully understand what they are investing in. The show might be too short to cover all of the aspects of the process. However, a mention of a passing inspection prior to the new owners moving in would certainly make it more transparent. Those on their own house hunt should keep in mind that fast-tracking the shopping and closing process could eventually backfire.

Being too flexible with location

It's no secret that in real estate, location is a huge factor for buyers. However, sometimes realtors on "House Hunters" seem to view it as an afterthought. When a family wants to be in a desirable school district or a couple wants a certain commute, the property they choose dictates that. Unfortunately, agents on the show often show them properties in other areas because they are in budget or tick more must-have boxes. But, what they fail to do, is remind their clients that the location of their property is the one thing that they'll never be able to change.

When the location is your top priority when searching for a home, commit to staying focused. You don't want to end up with a daunting daily commute because you were tempted by a lower price. You also don't want to uproot your school-age kids from a district you love because your search exceeded the boundaries. If you adore your area and know you'd be happiest staying put, remain patient until a nearby property comes on the market that meets your needs.

Assuming all buyers will face the same biases

"House Hunters" has championed inclusivity throughout its tenure on the air. The show has featured a refreshing mix of LGBTQ+ couples, buyers of diverse ethnicities, and families with unique blends of cultures. Even so, The Washington Post points out that the production team typically doesn't address the adversity that this can cause in some situations. While every buyer is essentially treated the same on the show, it leaves out some glaring possibilities.

This glossing-over effect signals that race, sexual orientation, and other facets of a person's identity are irrelevant in the home-buying process. As The New York Times highlights, black families have historically found it much harder to secure a mortgage loan than white families. Same-sex couples could also face an uphill battle in securing funding (via National Community Reinvestment Coalition). This is certainly not the case for every home buyer in a marginalized group. However, these buyers should be prepared with knowledge of these facts and the drive to overcome any adversity.